SENIORSERVICE FINANCIAL LLC

PROVIDING SOLUTION FOR FINANCIAL FREEDOM

Protecting Families

We have years of insurance experience helping clients prepare for the unknown. When it comes to IUL which is Index Universal Life Insurance, Whole life Insurance, Term Life Insurance, Expense Life, Annuities etc. We provide you the best and peace of mind.

Protecting Assets

With the mortgage protection plan, we have your mortgage covered, so you don't have to worry about it anymore when your loved one passes away. we will make sure the assets are paid in full, so you can have a calm mind to take care of the kids and pets

Education Expenses

With the IUL (Index Universal Life) Plan, you don't have to worry about taking a loan or getting money out of your wallet to pay for your child education, the monthly premium for your child education will keeps on earning compound interest for life. This fund can be used to take care of a whole lot of needs for your child without you touching your paycheck.

PLANNING FOR UNCERTAINTY IN LIFE

Building Trusted Relationship

Every individual and families have different challenges in life and will as well have different insurance needs. Give us a call lets evaluate your family or personal financial situation and see what insurance coverage best fits your needs .

Protecting You from Uncertainty

We have years of insurance experience helping clients prepare for the unknown. When it comes to IUL (Index Universal Life) Insurance, Whole life Insurance, Term Life Insurance, Expense Life, Annuities etc. We provide you the best and peace of mind.

SAFEGUARD YOUR FUTURE AND PROTECT YOUR ASSETS WITH SENIORSERVICE FINANCIAL

Retirement Planning

Make sure your retirement is well planned with SENIORSERVICE FINANCIAL. We offer a wide range of retirement planning options to meet your long-term financial goals.

Investment Management

Gain financial freedom with SENIORSERVICE FINANCIAL. Our financial experts will assist you in every step of the way to make sure you make the right investment decisions and manage your portfolio effectively.

Estate Planning

Protect your assets with SENIORSERVICE FINANCIAL. We offer estate planning solutions to help you preserve your assets and ensure they are distributed according to your wishes.

Tax Planning

Maximize your tax savings with SENIORSERVICE FINANCIAL. Our tax planning experts will help you identify opportunities to reduce your tax liability and optimize your finances.

Insurance Planning

Protect your assets with SENIORSERVICE FINANCIAL. We offer a range of insurance planning solutions to cover you against unforeseen events that may impact your financial wellbeing.

Wealth Management

Manage your wealth effectively with SENIORSERVICE FINANCIAL. Our wealth management services are tailored to your specific needs and goals, and designed to help you grow and protect your assets.

DIFFERENT TYPES OF LIFE INSURANCE AND HOW THEY APPLY TO EACH INDIVIDUAL

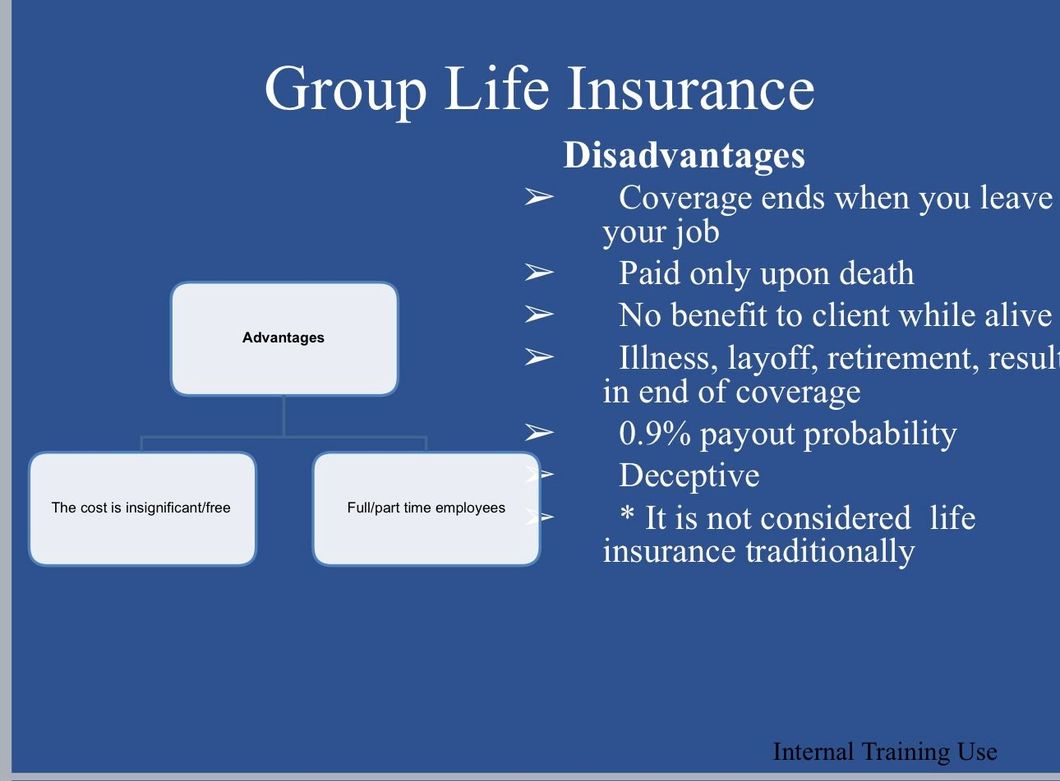

Group Life Insurance

- Group life insurance is typically provided through an employer or an association.

- It covers a group of people under one contract.

- It's often a basic amount of term life insurance, which may be supplemented by additional coverage paid for by the insured.

- Premiums are often lower, or sometimes even covered by the employer, but coverage usually ends when employment terminates.

- Some policies allow you to convert to an individual policy when employment ends.

- When you are hired by a company, the life insurance which is been offered to you by your employer 99% of the time is Term Life. This insurance policy only covers you for the length of time you are with that company. The moment you quit, retired, relieved or get fired from the job, the policy comes to a total and complete end. No money is given back to you despite all the money you contributed bi-weekly from your paycheck thought-out the years you spent while you were with the company. this means there's no cash value to the Term Insurance, and thus it's a waste of your money which would have been put into an IUL (Index Universal Life) Policy which has a cash value.

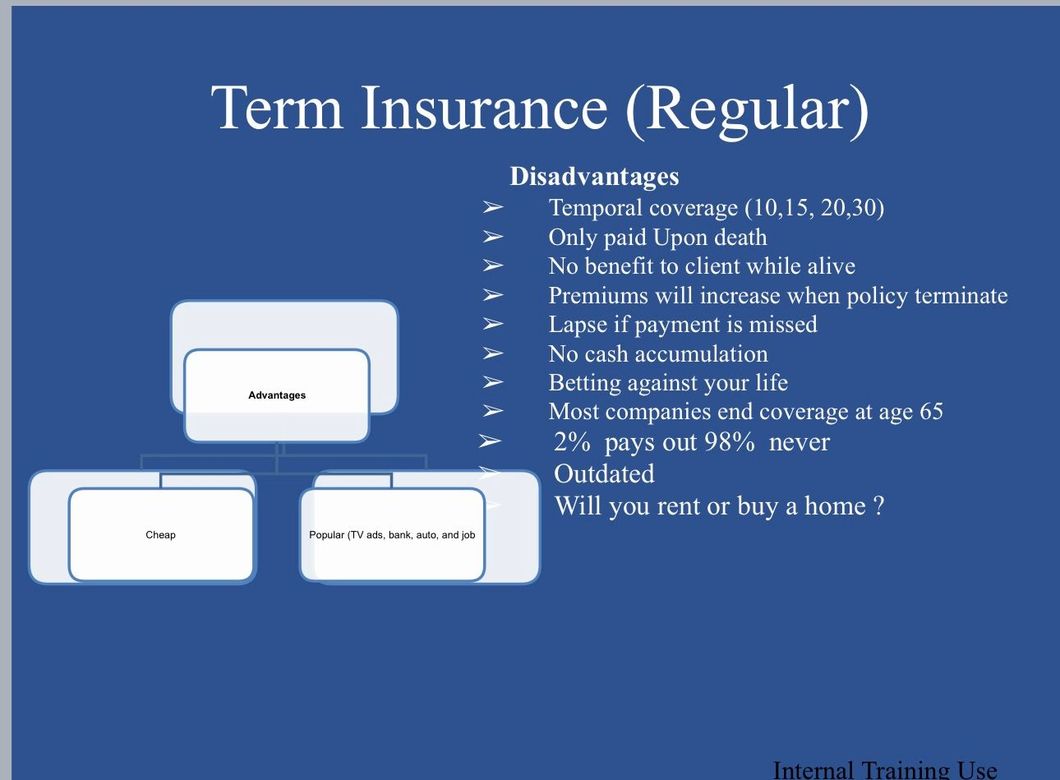

Term Insurance

- Term life insurance provides coverage for a specific period, or term (e.g., 10, 20, or 30 years).

- It pays out a death benefit only if the insured dies within the term.

- Premiums are generally lower compared to whole life and universal life policies.

- It does not build cash value.

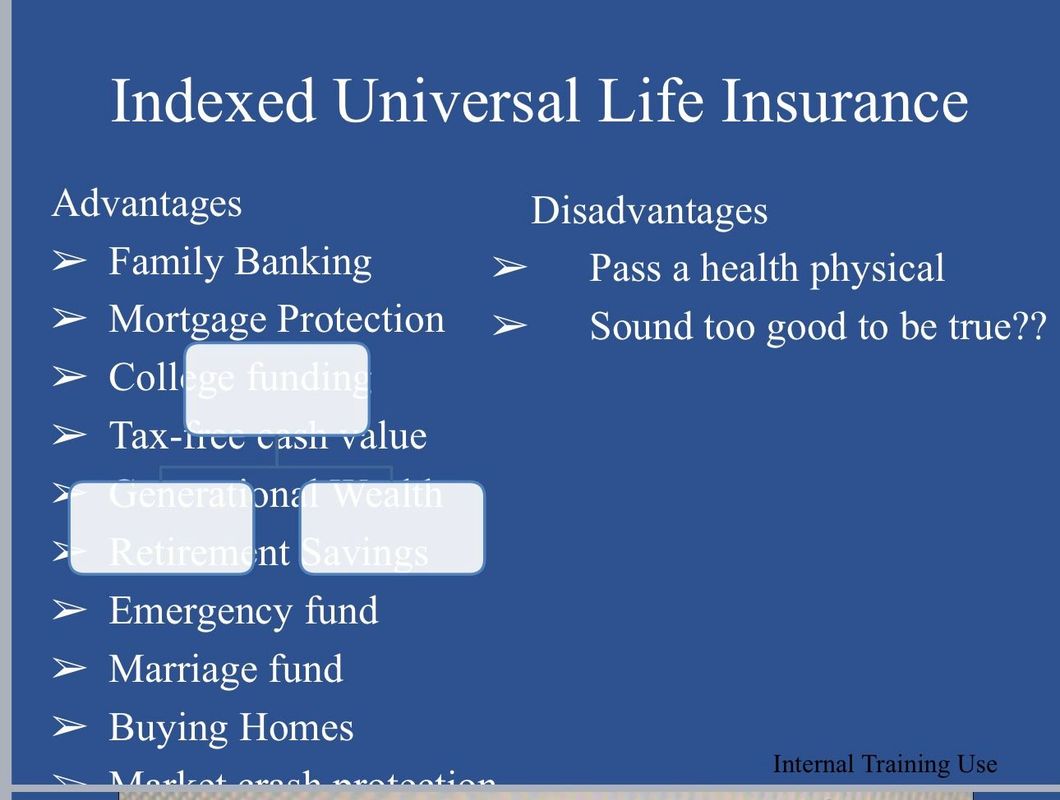

Index Universal Life Insurance

- IUL is a type of universal life insurance that provides lifelong coverage.

- It has the potential for higher cash value growth based on a stock market index's performance, like the S&P 500, but it also provides downside protection with a guaranteed minimum interest rate.

- Premiums are flexible, and the death benefit can often be adjusted.

- It allows tax-free loans or withdrawals from the cash value (though these will reduce the death benefit).

- IUL policies can be more complex and may have higher costs than other forms of life insurance.

Whole Life Insurance

- Whole life insurance provides lifelong coverage and pays out a death benefit regardless of when the insured dies.

- Premiums are generally higher compared to term life insurance but are fixed and do not increase with age or health changes.

- It builds cash value over time, which can be borrowed against. The cash value growth is at a guaranteed rate.

- Some policies may pay dividends (though they're not guaranteed), which can be used to increase the cash value or death benefit, reduce premiums, or be taken as cash.